Your tax home is the locale where your business is based. The answer may disappoint you.

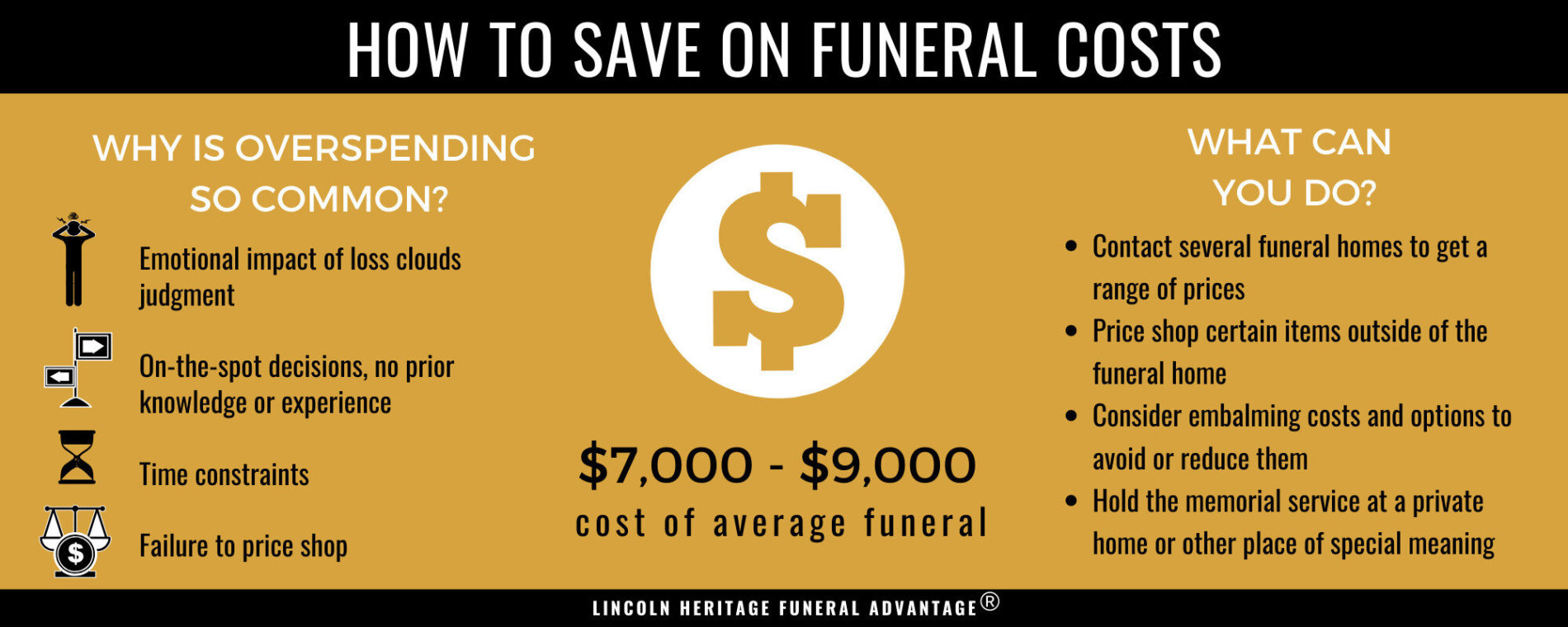

2021 Breakdown Of Average Funeral Costs

2021 Breakdown Of Average Funeral Costs

Some funeral costs are personal expenses.

Travel to funeral tax deductible. Qualified medical expenses include. While the IRS allows deductions for medical expenses funeral costs are not included. 21032021 Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

It is deductible under section 25-5 Income Tax Assessment Act 1997. Click to see full answer. Costs paid by a final expense insurance policy or other life insurance policy.

10102018 Heres what you should keep in mind. Even though medical costs are allowed funeral costs are not permitted by the IRS. 19022018 Funeral Expenses that Arent Tax Deductible.

18092019 To write off travel expenses the IRS requires that the primary purpose of the trip needs to be for business purposes. This ATO Tax Determination TD 20178 was issued 29 March 2017. This applies to the final return for the deceased and for anyone who paid funeral costs for the deceased.

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction. So no funeral and cremation expenses are not tax deductible.

If the taxpayers do not claim funeral expenses you may accept that no deduction is due. Individuals cannot deduct funeral expenses on their income tax returns. 06032020 Individuals cannot deduct funeral expenses on their income tax returns.

Most of the individuals cant claim burial expenses as tax-deductible. Because the cost of a funeral is not a medical expense it does not meet the Internal Revenue Service criteria to be deducted there. A son was executor of the estate and before the prescribed date for filing the estate tax return he paid the funeral expenses of 9000 of the debts using therefor 5000 of the bank deposit and 5000 supplied by the surviving spouse.

Writing off funeral expenses cannot be legally done on your tax forms. In short these expenses are not eligible to be claimed on a 1040 tax form. Toll and parking fees qualify as well.

14062017 No never can funeral expenses be claimed on taxes as a deduction. Attorney Accounting and Appraisal. According to Bankrate the tax credit was meant to cover up to 50 percent of any travel expenses over 50 within the US.

Qualified medical expenses mean it was used to prevent or treat an illness. If you can combine a business trip with attending a funeral you can write off some of your costs such as air fare overseas. This is when you are having your tax return prepared by a recognised tax adviser.

The IRS deducts qualified medical expenses. Travel expenses for members of the family to attend the funeral are not deductible as funeral expenses. Funeral costs including luncheon and head stone.

15012021 Travel tax credits intent. However if the expenses are paid from an individuals estate that it will be tax-deductible. Funeral expenses are not tax deductible because they are not qualified medical expenses.

Simply so can I deduct funeral expenses on. Heres how to make sure your travel qualifies as a business trip. And dont forget your standard mileage rate deduction.

Whether you fly take a train or bus or rent a car to get to your business meetings or conference you can deduct the expense. Funeral expenses of 1000 and debts in the amount of 29000 were allowable under local law. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

30032021 Post last modified. Theyre not eligible for tax deductions by the estate and individuals cant claim them on personal tax returns. The IRS recognizes business travel as a legitimate tax deduction.

To help keep money in the travel. 07122018 Individuals cannot claim a funeral expenses tax deduction on their personal income tax returns. When you visit your accountant or financial planner the cost of travelling is tax deductible.

17032018 Are Funeral and Cremation Expenses Tax Deductible. Deducting funeral expenses as part of an estate. You need to leave your tax home.

Travel expenses for funeral guests. For every mile you drive for business you can currently deduct 545 cents. Burial or funeral insurance is tax-deductible or not is a commonly asked question.

04052021 Individual taxpayers cannot deduct funeral expenses on their tax return. Qualified medical expenses must be used to prevent or treat a medical illness or condition. 13052013 You should keep receipts for the following expenses which are deductible on the PA Inheritance Tax Return and the PA final PA-41 fiduciary return.

Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction. Although a death grant may be payable under the National Insurance Acts you should not on that account.

How To Buy Term Life Insurance Online We Created An Extensive List On How To Buy Term Life Insurance On Life Insurance Quotes Life Insurance Content Insurance

How To Buy Term Life Insurance Online We Created An Extensive List On How To Buy Term Life Insurance On Life Insurance Quotes Life Insurance Content Insurance

What Should You Know About Tax Deductions As Per The Ato Tax Deductions Tax Rules Paying Taxes

What Should You Know About Tax Deductions As Per The Ato Tax Deductions Tax Rules Paying Taxes

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Mileage Tracker Tax Deductions Mileage

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Mileage Tracker Tax Deductions Mileage

You Can T Say Corporate Corruption Didn T Have A Good Run With This Deduction Facts Didyouknow Did You Know Facts Sayings

You Can T Say Corporate Corruption Didn T Have A Good Run With This Deduction Facts Didyouknow Did You Know Facts Sayings

Funeral Reef La Mirada Ca What Do You State On Funeral Blossoms Funeral Flowers Funeral Flower Arrangements Sympathy Flowers

Funeral Reef La Mirada Ca What Do You State On Funeral Blossoms Funeral Flowers Funeral Flower Arrangements Sympathy Flowers

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Gop Proposed Tax Plan What It Means For Investors Fidelity Tax Brackets Tax Rules Deduction

Gop Proposed Tax Plan What It Means For Investors Fidelity Tax Brackets Tax Rules Deduction

Tax Season Problems Funny Pictures Funny Memes Taxes Humor

Tax Season Problems Funny Pictures Funny Memes Taxes Humor

How To Handle A Loss In Income When You Re Deeply In Debt And Have No Emergency Fund Budgeting Money Budget Planner Free Debt Free

How To Handle A Loss In Income When You Re Deeply In Debt And Have No Emergency Fund Budgeting Money Budget Planner Free Debt Free

Is The Travel Expense Tax Deductible For The Death Of A Parent Abroad

Is The Travel Expense Tax Deductible For The Death Of A Parent Abroad

Funeral Bouquet La Mirada Ca What Do You State On Funeral Blossoms Funeral Flower Messages Funeral Flowers Get Well Flowers

Funeral Bouquet La Mirada Ca What Do You State On Funeral Blossoms Funeral Flower Messages Funeral Flowers Get Well Flowers

Travel Live Life Leave A Great Legacy With Amazing Sons And Grandkids Inspirational Quotes For Girls Boss Lady Quotes Determination Quotes Inspiration

Travel Live Life Leave A Great Legacy With Amazing Sons And Grandkids Inspirational Quotes For Girls Boss Lady Quotes Determination Quotes Inspiration

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

Travel Advance Request Form Templates 8 Free Xlsx Docs Pdf Samples Excel Templates Ms Word Funeral Program Template

Travel Advance Request Form Templates 8 Free Xlsx Docs Pdf Samples Excel Templates Ms Word Funeral Program Template

Sympathy Baskets La Mirada Ca Are Funeral Flowers Tax Deductible Funeral Flowers Sympathy Plants Sympathy Basket

Sympathy Baskets La Mirada Ca Are Funeral Flowers Tax Deductible Funeral Flowers Sympathy Plants Sympathy Basket

2021 Breakdown Of Average Funeral Costs

2021 Breakdown Of Average Funeral Costs

Are Funeral Expenses Tax Deductible Funeralocity

Are Funeral Expenses Tax Deductible Funeralocity

Tax Deductions For Funeral Expenses Turbotax Tax Tips Amp Videos Tax Deductions Funeral Expenses Freelancers Guide

Tax Deductions For Funeral Expenses Turbotax Tax Tips Amp Videos Tax Deductions Funeral Expenses Freelancers Guide

Post a Comment

Post a Comment